Canada supplies more oil and gas to the United States than any other foreign nation. Canada is also one of the United States' closest allies, if not its closest. Many Canadian petroleum companies trading in the U.S. provide exposure to petroleum demand while also providing above-average dividends compared to the broader market and also many traditional oil and gas equities.

Additionally, Canadian companies generally pay their dividends in Canadian dollars, which is largely natural resource-backed, even if also trading in the United States. That Canadian currency dividend is then converted into U.S. dollars. During 2011, the Canadian dollar weakened versus the U.S. dollar, but the Canadian dollar has been relatively strong over the last several years, primarily due to the strength of gold, oil and other abundant Canadian natural resources. The future strength or weakness of the currency will likely follow the price strength of ample resources Canada holds.

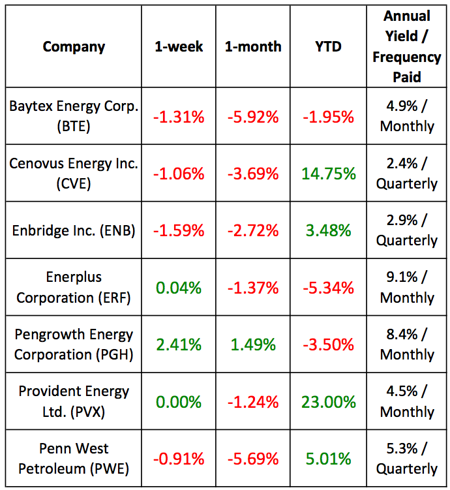

Below is a recent performance table for seven Canadian oil and gas equities that trade within the United States (listed in alphabetical order): Baytex Energy Corp. (BTE), Cenovus Energy Inc. (CVE), Enbridge Inc. (ENB), Enerplus Corporation (ERF), Pengrowth Energy Corporation (PGH), Provident Energy Ltd. (PVX) and Penn West Petroleum Ltd. (PWE). I have included their one-week, one-month and 2012-to-date equity performance rates, as well as their current yields.

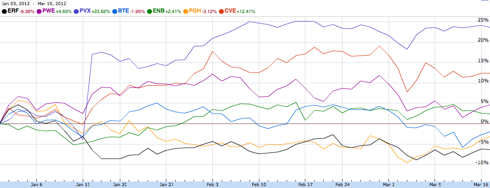

So far in 2012, the best-performing listed equity is Provident Energy, which largely moved up immediately following the company's January 16, 2012, announcement that it will be acquired by Pembina, another Canadian oil and gas company. Since then, Provident has performed comparably to the broader group. See a 2012-to-date performance comparison chart below:

2011 was an extremely volatile year for oil prices, starting with appreciating oil on account of instability within the Arab world, some of which is still not resolved and which is conceivably still in its infancy. Now, Iranian nuclear concerns and possible military responses are adding another potential elevating force to oil prices. On the other side, potential European fiscal problems and Chinese economic cooling could slow demand growth for oil.

Additionally, natural gas prices have generally trended lower for several years, with new technology increasing gas supplies far faster than demand growth for gas. Most Canadian oil and gas equities followed oil and gas price fluctuations, and haven't changed their dividend policies in several quarters.

Most Canadian oil and gas companies were Royalty Trusts ("CanRoys") before changes in Canadian law eliminated them. These trusts were similar to U.S. MLPs in that they avoided corporate taxation by passing most of their income to shareholders. After Canada eliminated these trusts, most converted into corporations. Some may need to further restructure themselves or reduce their dividends in the coming quarters, as many have tax credits that will eventually expire.

Disclosure: I am long PGH.

Disclaimer: This article is intended to be informative and should not be construed as personalized advice, as it does not take into account your specific situation or objectives.

How useful was this article?

Did you find this article useful?

Yes No

Sending feedback...

Thank you! Your feedback will help us better serve you and other readers.